Choice and Taxes

Making it Fair

For most of us, taxes have become part of nearly every aspect of our lives. We work to earn money to support ourselves and that income gets taxed before we even receive it. Then we go to buy the things we need, and we get taxed again on those purchases. Our homes and cars are taxed. We can’t even talk on the telephone without paying another tax.

So why do we need so many taxes? Couldn’t we figure out a way to do without them?

Most of us have heard the old saw:

Only two things in life are absolutely certain: death and taxes.

Why is it so?

In order to answer, it is important to first determine what kind of government is doing the taxing. Just like taxes, government can also exist for different reasons. But historically, most have fallen into one of two categories:

First, many governments have evolved to control large numbers of working people to get them to produce a high standard of living for an elite minority who run the government. Most people recognize this as a form of involuntary servitude, and thus, highly immoral.

In more ideal circumstances, governments are established as a cooperative means for protecting the natural rights of individual citizens. In America for example, we have a founding document, the Declaration of Independence, that explains how these rights include life, liberty, and the pursuit of happiness. The last one, the pursuit of happiness, is sometimes more simply expressed as “the right to own property.”

Under the doctrine of natural rights, it is understood, individuals have a right to work for their own betterment, and to enjoy the fruits of that labor. They do not, however, have the right to do things that deny these same freedoms from others. The idea is, we should be able to choose our own course as much as possible, and as long as we don’t create undue hardships for those around us.

Unfortunately, some people refuse to respect the rights of others around them. Rather, they may do as they please, or take what they please, without regard to how it affects other people. This implies another natural right—the right to defend ourselves against such aggressions.

In other words, if someone disregards my rights in the pursuit of his own, I should be able to protect myself—even to the point of violence, if necessary. I should not initiate violence against others. But I am justified in using it, if such is necessary, to protect myself or my associates.

Another harsh reality of life is, it takes a lot of work to survive—and much more work to live prosperously. The world doesn’t just provide everything we need. We have to sweat and toil for our food, our shelter, and the other comforts of living.

A final important principle involves our right to freely associate with other people. We can form groups, working together to accomplish various purposes, including our pursuit of happiness and our self defense.

When we do this on a large scale, it is sometimes called “civil society” or “government.” We make certain rules about how we are going to behave toward others in our society, or country. If you live according to the rules, you get to live free and participate in the civil society. If you break the rules, you could be punished or imprisoned—removed from society.

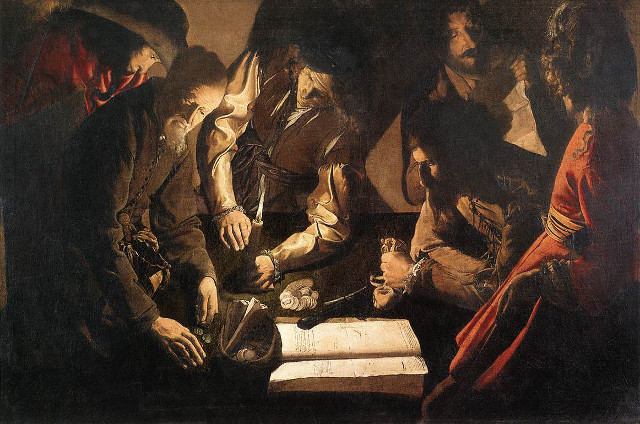

So, going back to taxes: If your government exists just to keep you working on behalf of an elite, ruling class, the purpose of taxes is pretty simple. If you are not in power, you do most of the work, and then you give some of what you have produced to the government. Those who are in power get to enjoy that money, or wealth. They determine how your labor is directed.

Depending on the morality of your government, it may also spend some of the money it collects on things that benefit you. But an immoral ruling class, may choose to just spend it on themselves, consuming it directly. They might use it to ensure their continued power over you. And they may live lives of comfort and opulence—far beyond the reach of the working class.

Under a more moral form of government, we look at taxes very differently. Citizens of a free country, enjoying their natural liberties, delegate certain of their individual duties to government so they can be performed more efficiently.

For example, there are certain people in the world who are willing to unjustly exploit others. Individuals have a right to protect themselves against such aggressions. By combining together, they can form a defensive military force and an internal law enforcement system. This way, a moral, civil society can protect itself from plunder by unruly insiders or hostile outsiders.

By cooperating, only a few have to work for the security of the whole society. The rest can engage in more directly productive activities like farming, mining, manufacturing and the like—providing for the living and wellbeing of the citizens. But these who do not serve in a military or law enforcement role are still obligated to support the ones who do. Otherwise, no one would enjoy the security necessary to live such productive lives.

Let’s look at it this way: If no one were associated together in civil society, it would be every person for himself. Every individual or family would have to raise their own food, construct their own tools, and see to their own self defense.

We can do much better by specializing and trading our labor with each other. Much of this can be done by privately trading with one another. But there are a number of things that can be done much better by an organized, centralized government. Self defense is a good example of one of them.

So even if you live under a moral form of government, you probably still need to pay taxes. Ideally, the purpose of those taxes is not to unduly enrich a ruling class. Rather it is to provide a fair and reasonable standard of living for those who serve our collective needs by working in government. If we didn’t have them, we would have to do that work ourselves. So it should be more efficient to contribute a portion of our productivity to fund the government services we want and need.

Taxes are a reasonable and necessary part of life as long as you want to live with relative freedom and security under the protection of an organized civil society. If you live under an immoral government that taxes you just because it can, taxes are also likely an inevitable part of life. But you would be well justified to leave that civil society, if you can—or perhaps cooperate with others in an attempt to reform or overthrow it.

Having accepted that we must pay taxes to fund our government, what then is the best way of assessing and collecting those taxes? Is there a good way and a bad way to tax? Are some kinds of taxes fairer, or otherwise better than others?

We will examine a number of different types of taxes, and try to assess the morality of each—particularly in the context of free will. The idea is, we have certain unalienable rights or liberties. In other words, people like to be able to pursue their own happiness as they see fit. So if we have to fund government by paying taxes, what specific method of taxation is most compatible with the idea of natural rights and personal liberties?

Income Tax

Most Americans are very familiar with the federal income tax. Many also pay income taxes at the state level.

What many people may not realize is, the federal income tax did not exist at all prior to 1913. In fact, it was explicitly prohibited by the original Constitution. It required a constitutional amendment, in order to make it legal. It is worth pondering how the nation managed to get by without it during the nearly half of it’s history prior to that time.

The idea of an income tax seems pretty simple. But like all things, the details can become rather complicated. It turns out to be a lot more difficult than one might think to decide what is, and what is not, taxable income. Will you tax the “gross,” or all your income? Or should you tax just the “net,” meaning what you have left over after all your expenses? In practice, it turns out to be even more complicated.

For example, if you and your neighbor each mow your own lawn, and weed your own garden, neither of you will owe any income taxes for that activity. But if you like mowing, and your neighbor prefers weeding, maybe you both agree to a trade. You will mow both of your lawns, and your neighbor will weed both gardens. But under current federal income tax law, the work you each did for each other could be considered as taxable income. Even though no money has been produced by the transaction, still you each could still be required to pay some money to the US Treasury.

So it can get complicated. The original American federal tax code is said to have been on the order of about 400 pages long. 100 years later, it would be nearly 75,000 pages long and growing. Congress and bureaucrats are still wrangling over the definition of “taxable income.” And the battle doesn’t seem to be ending any time soon.

Part of the problem is, taxation has natural consequences. For example, if you tax a certain activity, people will tend to do less of it in order to minimize what they lose to the taxation. So if you tax income, you are putting a negative incentive on the production of wealth. And that might be a bad thing if you want to have a growing economy.

The idea of taxing a percentage of income has some potential appeal in terms of fairness. Under a moral system, everyone who benefits from government services should pitch in and do their part to fund those common services. If everyone is working and earning income, it does seem fair to have everyone pay a certain percentage of what they earn to pay for the benefits they all enjoy.

But the power of taxation to change behavior serves as a huge source of power for politicians and political activists. They want to change the way you live your life. And they can’t resist the urge to try it by manipulating the tax code.

These special interests lobby Congress for their own version of fairness. They seek to reward the behaviors they want, and punish the ones they don’t.

Today, taxation has become extremely political. The parties usually fight for tax policy to benefit their own voting constituencies. And when they succeed, it lays a disproportionate burden on the constituents of the opposing party.

As long as Congress has the power to gerrymander a complex, incomprehensible federal income tax code, we can expect this trend to continue. And the more it does, the more we will become like the immoral government discussed previously—where a few people try to live at the expense of many others.

Another negative aspect of the income tax is how it has been used to factionalize our society. It is common political rhetoric to talk about ”taxing the rich.’ You can decide for yourself whether or not you think that is moral. But you should understand, the income tax does not accomplish it very well.

An income tax does not tax wealthy people. Rather, it taxes people who would otherwise be on their way to becoming wealthy. Strangely, it protects people who are already rich, from poorer people joining their social ranks. This can perpetuate, or even exacerbate the divisions of class in a society rather than bringing them together in a common purpose.

When taxing income, we might also ask whether we will collect it from people, corporations, or both. A corporation is just a group of individuals, working together in common. Each one owns a certain share, or percentage of the company. And they share any profits accordingly.

In America, we tax income at the corporate level and then again at the personal level. As an example, imagine you own part of a corporation. If that corporation earns a profit, a large chunk of it will be paid to the government before you ever see it. Then, what is left can be distributed to you and the other owners of the corporation. When this happens, it is counted as income to you personally, and you pay taxes on those same profits a second time.

Many people who don’t own corporations think this is a great arrangement. After all, corporations should have to pay taxes just like people, right? But a corporation is not a person. And it doesn’t really earn anything anyway.

Rather, it is the people working together within the corporation that earn the profit. And that profit is owned by, and eventually distributed to, the people who own the corporation. So, of course, they should be taxed on it. But should they be taxed twice, or just once like everyone else?

A corporation is just an entity that represents its owners’ mutual interests. Profits accumulate there in preparation for reinvestment in the company, or ultimate distribution to its shareholders. It is just a holding location for money while that decision is being made. Imagine if every time someone sent you a check, your money was taxed once when it was deposited into your bank account, and then a second time when you withdrew it. You probably wouldn’t like that very much.

One other problem with taxing corporations is it can be a huge barrier to economic growth. A company that constantly pays its profits off to government can’t reinvest as much in its own expansion. And growth is what creates jobs for working people like us. Tax corporations and you get fewer jobs. That means fewer people are actually working to produce the wealth we need to fund government.

Another complication is, profits do not always accrue as cash, like we might imagine. For example, in a typical manufacturing company, income often includes things like an increase in inventory or an increase in the amount people owe to the company, or “receivables.” Even though these things are not cash money, still the government forces your to pay taxes on their increase. So many companies may be forced to borrow more and more money, just to be able to pay their taxes. While this is great for big banks, it is very harmful to the company and its ability to grow and hire more employees.

Property Tax

Many states and counties make use of a property tax. This might be in lieu of an income tax. Or it might be in addition to it.

The idea is, if you own real estate, you will have to pay a percentage of its value, each year to the government. If you don’t, they can take your property away from you and sell it to someone else.

In some cases, property taxes even go beyond the idea of just real estate. Some people also have to pay property tax on their supplies and equipment such as cars, machinery and so forth.

Property taxes have significant potential ethical issues. For example, imagine you are unemployed or retired and you own your own home. You still have to pay cash money each year to the government, even though you may not have any income.

In a very real way, it is as though you can never really own property—you just perpetually rent it from the government. That concept is not very friendly to the notion of natural rights expressed in the Declaration of Independence. If you can never really own the fruits of your own labors, how can you have the freedom to enjoy the pursuit of happiness?

Some people view real estate as a part of the commons and therefore something individuals shouldn’t really be allowed to own in the first place. If they can’t ban private ownership of land, the property tax is a pretty good way of approximating the same result. It seems to be a way of charging people for the privilege of using a resource that really belongs to the whole of society.

This argument does have an appeal to some. After all, certain natural resources are in limited supply. It might seem unfair that certain people can own it while others may not.

But this approach quickly breaks down once a person invests time and energy into building structures or other improvements on their land. Who then owns those improvements? Can a person’s time and labor also be considered a part of the commons? Likely not. Rather, free people should have a right to keep that for themselves.

As previously mentioned, taxes have consequences. If you tax a certain activity, you are likely to get less of it. So taxing property ownership can discourage people from owning property. But just avoiding ownership of property may still not save anyone money in property taxes. The property tax still flows through to everyone who even uses property, whether directly or indirectly.

For example, you may not own your home, you may just rent it. But you can be sure, your rental rate has been adjusted to account for the property taxes the owner has to pay. You may not think you are paying it, but you are.

In the same way, the price of the food you buy is adjusted to account for the property taxes paid by the grocery store and all of its distribution facilities. This applies to everything you buy, from cars to movie tickets. And it doesn’t happen just once. It happens at every level of production from the raw materials, up to the finished product.

In some ways, this is good for fairness because it spreads the tax burden widely across society. But in other ways, it can be unfair, because the tax is hidden for so many people. They may not really get a chance to choose, for or against, in a fully informed and democratic way.

Sales Tax

Recently, there have been some efforts to pass a national sales tax, on the grounds that it is fairer than other methods of taxation. While this may be true, the sales tax is not perfectly fair either. Again, taxes tend to reduce the activity being taxed. So put a tax on sales, and you will get fewer sales, or less consumption of goods and services.

This means people will buy fewer things and maybe just save their money or work fewer hours. While saving is generally a good idea, it does not do much to help an economy grow. And working less is not good for an economy either.

When people are actively engaged in producing, buying, and selling, the economy does better, there are more jobs available for the people who need them, and the standard of living goes up for everyone.

Some bureaucrats favor a sales tax because it places the burden for tax collection onto businesses. There are fewer businesses than people, so the government’s job is arguably smaller. But this does not reduce the amount of work involved in administering the tax. It merely shifts the burden somewhere else. Ultimately, companies just have to raise their prices to cover the additional expense.

A further problem with the sales tax is, some people can avoid it by doing less formal trading with each other, rather than buying things at larger, established businesses geared up for the collection and payment of taxes. A farmer who trades his produce with others in the neighborhood may pay less than someone who lives in the city and has to get all his food from the grocery store.

Under moral government, people should share the burden equally. They should be fully informed about how much tax they are paying. And they should have a chance to vote for or against those taxes, or at least the representatives who institute them.

Finally, government should have the courage to tax its citizens directly—not in a hidden way, by forcing some other citizen or corporation to become its tax collector.

Capital Gains Tax

Most of us have heard of this tax but many—apparently even some prominent politicians—do not fully understand it. To some, it might sound like some esoteric detail only your accountant has to worry about when filling out your tax form. But it is something everyone should take the time to fully understand.

It isn’t really that complicated. Just think of a tax people pay on profits they earn as a result of their investments.

Imagine you buy a house for $100,000 and then 10 years later, you sell it for $180,000. You have realized a profit of $80,000, so the government says you must pay some of the money, say $20,000, to them.

Proponents of the capital gains tax say it is important to tax these gains because many people make their money solely on investments. They should have to pay taxes, just like everyone else who works for a living.

Some opponents of the tax, say it is important to encourage investment in businesses and other ventures. If we tax those investments, we will get less of them and hence, fewer new jobs and income opportunities for others.

But there is a much bigger ethical problem with the capital gains tax. It is artificially skewed by inflation. Consider the example above. You most likely did not really earn a profit on the sale of your home—at least not when fairly scored against your initial investment.

Sure, you just got 80,000 more dollars from the sale than what you had spent when you originally purchased the home. But those dollars are much less valuable than the ones you had spent 10 years earlier.

To prove this, just take the $180,000 and try to buy another house with it. Your new home will not be any better than the one you just sold. So your house did not really go up in value—it just went up in price, as measured by less valuable dollars.

The problem is, you still owe a bunch of money to the government from the sale. So the next house you buy will be $20,000 less house than the one you just sold. You haven’t been taxed on your profits. You have been taxed on the inflation that occurred during the time you owned the home.

And that is definitely not fair.

Wealth Tax

This is partly a theoretical idea since we don’t really have anything called the “wealth tax.” But the general idea is not to tax what people are earning, but what they have already accumulated in money and property. Understandably, this is not a very popular idea among most people.

Imagine if you had worked for years to pay for a house, a car and some savings. Then each year, you are required to surrender a portion of it to the government even if you are no longer even earning an income.

Those who favor taxation for the purpose of wealth redistribution should favor a wealth tax. If you really wanted to bring down the wealthy, that would do it. But for some reason, the focus is more often placed on taxing income.

One notable disadvantage of a wealth tax is, it robs an economy of money that could otherwise be used for investment capital. For example, once people have accumulated enough wealth to see to their own needs and the needs of their family, they typically begin to invest the excess. This money goes into existing and startup companies who hire more people and buy more materials and equipment. That in turn, improves the quality of life for a large number of people.

Perhaps, the biggest problem with taxing wealth is, it is antithetical to the idea of individual property rights. It tells people, it doesn’t matter how hard they work. Even if they manage to build a good standard of living for themselves, the rest of society will just take it back away, a bit at a time.

There is no incentive to create, to build, or to work hard. And so no one does.

In a society built to serve an elite ruling class, this might serve its purpose perfectly—as long as the rulers find a way to exempt themselves from the tax. But in a society built to protect individual rights and liberty, people should be allowed to enjoy the fruits of their own labors rather than having it all appropriated by government.

Death Tax

A tax on inherited wealth is sometimes called the death tax. This just means when you die, everything you leave behind will be taxed at a certain rate.

Admittedly, there is some appeal to this idea. After all, you are done with life—you don’t need your wealth any longer. Why not give a generous share of it to society?

But there are several legitimate arguments against this approach. First, imagine you have worked your whole life, paying income taxes, capital gains taxes, and sales taxes. Still, you managed to keep something for yourself and over your lifetime, it has now amounted to something significant. Why shouldn’t you be able to dispose of that wealth according to your own final act of free choice? Why is society entitled to get any more of it?

A bigger problem comes when your accumulated wealth is not in cash money, but perhaps is instead in the form of a business or a property. Let’s say you have managed to pay off a 1000 acre cattle ranch which you had hoped to pass down to your children and their children. Under a death tax, you probably won’t be able to do it.

Even though the ranch is not money, its value can be measured in terms of money. Imagine the land is valued at $10,000 per acre, so the government determines your kids have just inherited $10 Million dollars of wealth. The tax is due now. It doesn’t matter if they have the money to pay it.

If they want to keep the ranch, they will have to borrow millions of dollars from a bank to pay the tax. And if they can’t to that, the ranch will be sold to the highest bidder, the tax will be paid, and they will get whatever may be left over.

So an inheritance tax makes it very difficult to pass along things like farms and other businesses. A family can easily lose them, and that represents a loss of heritage and continuity to society—not just the family.

Time Tax

It is easy to notice, there are many bad things to say about each of the various methods for taxation, and not very many good things. It turns out to be pretty difficult to implement any kind of taxation without bringing some kind of unintended harm upon individual rights, productivity, or the common good. So we are left to try to find the least bad, or the best of the worst methods.

And this brings us to the time tax. You probably haven’t heard of it before, because it doesn’t really exist—at least not yet. And it has its own set of technical challenges. But if it could be made to work, it would be the fairest tax of all.

Remember, the purpose of moral government is to protect our rights, and to allow us to live our lives and pursue our own happiness and fulfillment. But in order to live free under such a government, we all need to contribute some of our own productivity to support it. Everyone can benefit from the protection of a moral government. So everyone should have a part to play in its support.

Most of us remember the cry from the Revolutionary War:

No taxation without representation!

The American colonists recognized, it was not fair for England to lay taxes on them without also giving them a say in the matter.

It may be slightly less intuitive, that it is equally unfair to have “representation without taxation.”

Imagine a society where everyone gets to vote, but only some people have to pay the resulting taxes. This can easily happen in a pure democracy. The majority can vote to lay taxes on the minority. And they can enjoy the benefits of that taxation without contributing their part.

In a system that values choice, there must be an even balance between taxation and representation. If you pay taxes, you should be able to vote. And if you can vote, you should pay your fair, and even share of the taxes.

Income taxes sometimes distribute the burden unfairly because not everyone earns income—at least not always in the traditional way. Property taxes can be unfair because not everyone owns property. Sales taxes tend to put a higher burden on the poor. And some people are in a better position to avoid them by trading with each other informally, avoiding commerce with established retail businesses.

But everyone has time. And what’s more, we all have the same amount of it each day.

We believe all people are created equal—not the same, but equal. This means, in a moral civil society, we should all have equal access to the benefits and protections of our government. And we should all do our fair and equal part to support and sustain it.

We all have 24 hours in a day, 7 days in a week, and 52 weeks in a year. What if we all contributed the same percentage of our time, or its equivalent, to the maintenance of our government, at each applicable level?

At the federal level, we would simply compare the funding needs of the government to the total amount of productivity generated each year in the economy. For example, assume in 2015, total U.S. federal expenditures were around $3.8 Trillion. For the same period, Americans produced about $18 Trillion of total goods and services. So the math is pretty simple—that’s about 21% of everything we do, being required to support the services of the federal government.

If we were to distribute the burden evenly by money, every man, woman and child would have to pay around $12,000 in taxes annually. But this doesn’t seem very fair. After all, some wealthy business owners could earn $12,000 in a day or less. A professional athlete might earn as much in an hour. But many young people and other inexperienced workers might have to work an entire year to earn such an amount. Certainly the burden would be greatest on the poorest among us.

But if we split the burden equally by time, an interesting thing happens. First, everyone becomes acutely aware, exactly what the burden of government really is. In our example, it is 21%. So in a normal year, consisting of about 250 work days, about 52 of those days would have to be dedicated to supporting the federal government.

One way to think of it is, you would work from Jan 1, until sometime around the middle of March to maintain the country. Or, you would lose about one day out of each week throughout the whole year. The rest of your time would be available for your own purposes.

Too high a burden, you say? Great! You are beginning to feel more accountable already! This is a perfect time to have an honest public discussion about what services we all want our government to provide, and what is a reasonable amount of our time to give up in exchange for those services.

But under the time tax, we all conduct that discussion as equal citizens, on a level playing field. Currently, we allow our partisan leaders to bicker and fight over who will fund the tax bill, and who will get the benefits. Democrats fight for policies to shift the burden to Republican voters. And Republicans try to shift the load back toward Democrats.

We end up with divided government, and a divided country. We fight, but no one wins, except the politicians who manage to get the most votes. And not much really gets done for the public good.

If instead, we change to a time tax, that all goes away. Republican voters have just as much time as Democrat voters and vice versa. Instead of fighting each other, we could change our debate to something that actually helps—like how to operate our government in the most efficient way possible. How could we get the most in valuable services for the lowest possible cost?

If the public is comfortable with 21%, we just accept it and contribute our time at that rate. If instead, we all vote to lower the rate to 15%, then government might actually have to cut something—like its least important services. Or maybe it could cut out a bunch of waste and fraud—learn to do what we expect for a whole lot less of our time and money.

The tax burden would be much more very fairly distributed. That professional athlete would pay millions of dollars every year. But the entry-level employee, at a minimum wage job might only pay $3000 a year.

Still not fair enough, you say? There is a valid point to be made: a minimum wage worker might have a hard time paying even $3000 a year. We currently deal with this issue by providing exemptions, or creating a zero-tax bracket for low wage earners. But this is just the kind of divisive politics that have gotten us into trouble in the first place.

The better approach is to first insist everyone make their fair contribution to fund government. Spread the burden equally to everyone, no matter how heavy. Then, where there are people who can’t live on what they have left over, let us use our many different forms of compassion and financial assistance to give them the help they need.

There is no reason the poor shouldn’t have to pay taxes on their time—just like everyone else. We can then measure what they have left over to determine how much additional help we will give them in forms such as welfare and medicaid.

The point is, we shouldn’t be insulating any citizen from the pain, or the joy of knowing he is doing his fair share to fund needed government services. Then, we do what is necessary to make sure less affluent people aren’t left behind in poverty. This way, the decision can be a conscious and democratic one—not one fought on the battlefield of partisan politics.

Implementation

So a time tax sounds great, you say. But how could it really be implemented? Right now we just measure taxes in units of money and that seems a lot easier to understand. How do you effectively tax a person’s time?

Most everyone is familiar with the old saw: “Time is Money.”

This is just a convenient and familiar way of describing where nearly all value comes from. It comes from our work. The earth contains natural resources. But in order to make them valuable, or usable, we have to add our labor.

We might have to dig minerals out of the earth or plant and harvest crops. We might work to refine ore, or to manufacture goods of wood or iron. And even after things have been built, we have to transport them to where they are needed most. These productive activities define the very value of the goods and services we create and use.

So we use our time to create the things of value we need in our lives. Money is just a measure of that value. It is a credit against the work we will do as we perform the work of production in our economy.

So in a very literal sense, time is money. We use our time to produce value, and that value is measured in money.

So a time tax would most often be paid in money—just like any other tax. But it would be measured, indexed, or assessed according to the value of our own individual time. To see how it would work, let’s look at some examples.

Many people’s only real source of productivity is a regular job. They go somewhere each day to do whatever work the boss tells them to. Then, every so often, they get compensated—most commonly by receiving money. Since they know they can trade the money for the other things they want and need, they are willing participants in this arrangement.

In this case, the money earned, or income, is a pretty good measure of their productivity. Nearly all their non-leisure hours are spent at this job. And all work done at the job is compensated by money. So if you measure the income, you have effectively measured the time. Tax the income, and you have taxed the time. In short, an income tax is a pretty good approximation of a time tax for this particular person.

It is important, the tax rate be kept flat. This means everyone pays the same rate (21% in our example above). If you work for a lot of money each day, you should pay a lot of money in taxes. If you don’t earn very much, your taxes will be much lower. But what is really being taxed is your time—not your income. Your income is just the most accurate way to measure the productivity of your time.

Many people don’t have this kind of a regular eight-to-five job. Consider next a woman who makes her money primarily from investments. Let’s say she buys old homes, fixes them up and then sells them again. The money she earns will be comprised primarily of capital gains. So each time she sells a house, she should compute the profit earned, and then remit her 21% of those profits for federal taxes.

The only real twist is, these gains should likely be indexed, or adjusted by the amount of inflation to keep things fair. If she held the investment for a long time, maybe some of her gains are not really profit, but simply due to the money gradually losing its value. So she should’t have to be taxed on that—just the real profits of actual value from her activities.

Next, let’s consider a man who lives in a state with no property tax, and owns a large enough property to maintain a largely independent lifestyle. He raises his own cattle and crops, and he gets water from a well. His power comes from solar cells and he has a shop and tools to do his own repairs and maintenance. He has no regular income and he earns no capital gains. Shouldn’t he rightly contribute his fair share to the federal government too?

What about a stay-at-home mom or dad who has no employment, but works full time raising and maintaining a family? What about an independently wealthy man who has sold his business and now races cars and yachts, lives a lavish lifestyle, and will not have to do any real work for the rest of his life? Shouldn’t these people also have a responsibility to participate in the funding of public services? Or are they somehow exempt?

Under a time tax doctrine, everyone would do their part. The only exemptions would be for the very young, or those with such grave physical or mental disabilities that they lack the ability to contribute anything at all. But how can you tax the time of someone who is not productive—at least in terms of measurable money?

One important way would be to allow people to give of their time directly. A stay-at-home parent could find time during the day to volunteer at a local, government operated facility like a school, a national park, a post office, or a welfare office. Our civil service does not have to be entirely run by professional, paid employees. Certainly, much of the work could be done by volunteers.

In fact, to the degree such public volunteer service positions could be made available, we should make them available to anyone who wants to serve society in this way. Imagine doctors, engineers, lawyers and accountants finding valuable ways to give public service directly by donating some time to their community. This would be particularly valuable given their talents, abilities and professional expertise.

And what about those who are idle, not engaged in productive employment, and who don’t choose to give of their time and talents directly? For them, a sales, or consumption tax may be a good measure of how they spend their time. If someone doesn’t earn any new money, but just spends a bunch of inherited money every year, maybe he should pay 21% of that to support public functions.

It is a valid initial reaction to wonder how we could charge a sales tax to one person and not another. But this is just because we are stuck in the current mind set. Right now, the sales tax works by assessing it from vendors, or businesses. The idea is, the business marks up its products when you pay, and then remits the tax money to government.

But government does this out of habit, because it seems easier, or because they are afraid of taxing voters directly. It would be just as effective to compute a sales tax on your regular individual tax form. You just keep track of how much wealth you had at the beginning of the year, and how much it increased or decreased during the year. Take into account how much in income and losses you incurred during the same time period. And what is left over, represents how much money you spent on goods and services.

It doesn’t matter what state you spent it in, or even if it was in the same country. It still shows how much you consumed. So if you just use your time for spending, you can pay tax on that amount.

So you get the idea. The point is, we don’t all have to have our tax amount computed in exactly the same way. The general principle is to make the tax proportionate one’s time at his own individual level of productivity. Whatever you do with your time, that is what gets taxed. If you don’t produce anything with your time, either contribute some of your time directly, or contribute some of the wealth you would otherwise be consuming.

Is it really possible to use different computation methods with each different citizen in order to focus in on time? Certainly, with today’s technology we could do it. And no matter how difficult it is, it couldn’t be any more complicated than the current federal income tax code. But there is still an even more important principle we will consider next.

Distributing Taxation Authority

What were the American founders thinking when they specifically prohibited the federal government from taxing citizens directly? Among other things, they expected people to be citizens first, of their respective states. They recognized, people would be subject to the laws and policies of the legislatures in those states. And those people could gravitate to areas with the most favorable and efficient methods of government. This diversity of state governments would allow the best practices to evolve and thrive while the less effective ones would be phased out and abandoned.

This vision included how we would be subject to taxation. In other words, individual states would not have been expected to assess taxes in exactly the same way. The original constitution allowed for taxes to be laid by the federal government as long as they were not applied directly to the people, and they were allocated uniformly throughout the states. So for example, the federal government could examine census data for each state, and require the state to remit its share of the federal budget. It would then be up to the states to pick an income tax, a property tax, a sales tax, a time tax or something else.

There are several potential benefits to this approach. First, it gives states more power in relation to the federal government. Instead of money flowing directly to the federal government, and then trickling back down to the states, the opposite is true. Tax money flows to the states and they then remit what is necessary to fund the federal government’s operations.

The other advantage to this approach is, people are subject to a smaller bureaucracy—at the state level instead of the federal level. The idea is, you can deal better with smaller government so there are likely to be fewer abuses and injustices. And if things get bad enough in your state, you can try living somewhere else where things may be done more fairly.

So one approach is to decentralize taxation but focus on the idea that everyone shares equally in funding the burden of government. Each person gives of himself and his own time in an equal proportion. But you interact with a local entity, more able to understand the way you live your life and how your productivity, or lack thereof, can most fairly be assessed.

In fact, the idea of decentralization can be adopted at the state level as well. For example, a state might pass the administration of taxation down to a county level. At this level, even fewer taxpayers are involved so it would be easier to keep track of how each person will contribute to the funding of his government.

There is also another additional potential advantage: You would really only have a single tax to pay. For example, the federal tax burden might settle in at 15%. The state burden might be 5% and the county burden another 5%.

Under this scenario, your total tax burden would be 25%, all to be remitted directly to your county assessor. The county would keep the 5% for its own operations and pass the remainder up to the state. The state would keep what it is entitled to and pass the rest up to the federal government. You pay one tax, one time, and to a single local agency.

And you can choose the state and county where you want to live—where you get the best balance of tax rate and public services rendered. If you don’t choose a state and county, maybe the federal system would just assign you to one. Or maybe you would pay at the maximum rate of any county—just to make sure you play by the rules.

Conclusions

There are two purposes for government—one moral and the other not so. Likewise, there are legitimate and illegitimate reasons for taxation.

In the ideal situation, government exists to protect our individual rights and to provide common services we widely agree upon as appropriate and necessary. Under this ideal, everyone should benefit equally from the government services they choose in a democratic and fully informed process. Everyone should also do his or her part to fund those public functions. And the fairest and most moral way to apportion this burden is based on a percentage of our time.

Government services and the taxation that supports them have become much too political. Too often, those who exercise power in our government distribute the benefits of that government only to a favored few, rather than in a fair and impartial way. And not everyone agrees on what kind of services should be provided at the government level.

The solution to how much we should concentrate in government services is found in decentralization. We should deliver a very small core of services at the federal level, where everyone is subject to the resulting burden. The fuller range of government services should be provided at the state, or even the county level where people have a greater degree of freedom to move and find the jurisdiction that best meets their individual needs and expectations.

Federal funding should be used only to supply the small core of federal services. Lower jurisdictions should lay taxes as necessary to fund their own operations at the scale decided by their own democratic processes. And one jurisdiction should not be forced to subsidize another, who may have a very different idea of what services government should provide.

Another way of saying this is, there should be no more federal grants. Every unit of government should be self-funding, from the bottom up—not from the top down.

And finally, the burden of government should be spread evenly, or uniformly as the Constitution requires. Everyone should do their share and be a part of the common operations of their civil society.

This will make us more unified as a nation.

It will protect and enhance our individual rights.

And it will make us more happy, productive and prosperous as a people.