Got Choices?

Legal Tender

The power of the Federal Reserve to monopolize money has been further reinforced by the notion of “legal tender.”

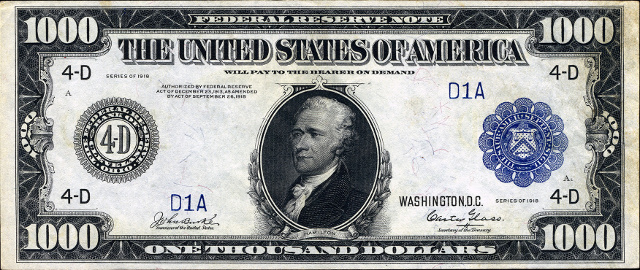

Along the top of a dollar bill you can see the words “Federal Reserve Note.” This is a reminder that it is currency issued by a private institution and not the Federal Government. Regardless of whether it is physically printed by the US Treasury, the note, or obligation is issued by the Federal Reserve, an entity separate and apart from the government.

Furthermore, the obligation is denominated in dollars–not gold or some other commodity. So you can only redeem the note for more dollars. It seems like a cat chasing its own tail.

The key phrase to notice on the front of the dollar says: “This note is legal tender for all debts public and private.” As we shall see, this is an indication that citizens of the country may be forced to accept it as payment in certain circumstances, even if they don’t want to.

As discussed previously, one of the critical functions of government in a civil society is to enforce the contracts we have voluntarily entered into with with each other. Commerce will be much more efficient when we can be sure others will keep their part of a bargain.

For example, I might deliver some food or clothing to you with the agreement that you will pay me later. This is often referred to as short term private credit.

Perhaps we want to become partners in a certain business enterprise or we wish to exchange labor for money or services. In each of these cases, it is important to be able to trust the other person to fulfill the promises made in the agreement.

In order to be confident of these relationships, we need an authority who will force otherwise non-complying parties to live up to their commitments. Otherwise, the burden is left up to individuals to enforce their own agreements. And this is more likely to devolve into the “law of the jungle” where superior strength is the only way to prevail.

In some instances, legal tender laws may specify that if a contract is made where payment is expected in exchange for goods or services, then the provider must accept the official currency in full satisfaction of the debt. But what if the issuing bank or government irresponsibly inflates the currency over a period of time until its value is no longer dependable? It doesn’t matter. You may still have to accept it.

As a more specific example, imagine you agree to sell a house today for $200,000 dollars, payable two years from now. But in the intervening period of time, a financial crisis hits, there is mass devaluation of the currency and $200,000 is no longer enough to even buy a car, let alone a house. You might wish you could go back to your buyer and require him to make payment in gold or silver–something that still holds enough value for you to buy another home. But a legal tender law may well forbid this–particularly if you haven’t made an explicit agreement with your buyer, in advance.

You might have to accept the $200,000 even if it is now worthless. It doesn’t matter whether the money can be trusted or not. It has the official sanction of government. So if you don’t accept it, the government is not going to help you collect the debt in any other way.

Prior to 1933, it was fairly common in the United States to deal with this problem by making contracts that included a gold clause. The creditor was given the option to require payment be made in gold, instead of dollars. This way, if the currency lost too much value during the term of the debt, the creditor could simply refuse to accept it.

In 1933, the Congress passed a legal tender law making such gold clauses unenforceable. Creditors had no other recourse. They were forced to accept the government sanctioned form of payment. That law remained in effect until 1977, when it again became allowable to create a contract specifying payment to be made in gold.

Such laws are another example of big government working hand-in-hand with big business to create regulations to prevent small business from competing with them. In this case, the government effectively prevented the use of any money other than the official Federal Reserve money. That gave the banking monopoly much greater power over the economy than it otherwise would have had.

Although the misguided law was eventually repealed, it did cause some permanent damage. It taught government that it can just make an oppressive law any time it seems necessary to protect an otherwise failing currency. It taught creditors that they can not always trust government to enforce their contracts.

Ironically, the law also ended up hurting debtors, in the long run. Creditors would now have to charge higher rates and fees to cover the additional risks of capricious government.

Nearly all of us enjoy the freedom to decide where we will shop to buy our groceries each week. We enjoy choosing what movie we want to go see and what restaurant we might visit afterwards. We like to decide where we will take a vacation. And if we can stay far enough ahead of our bills, we would even like to decide how long that vacation will last.

Shouldn’t we also decide what kind of money we prefer to use? Isn’t it better if we can compare the relative strengths and weaknesses of a variety of different money options? Then, as long as buyer and seller were both in agreement, the transaction can take place using any kind of payment they might agree to be best?

This is the concept of “complementary currencies.” Rather than having only a single, government sanctioned money, we can have multiple viable currencies. Consumers can then freely choose the ones they are most comfortable with.

The advantages of such a system are clear. Various currencies can compete for the confidence of the people. The ones based on the soundest principles will enjoy the greatest success. And other, less reliable methods can gradually fade away.

Thanks to the natural economic forces of diversity and evolution, our money will gradually become:

- More dependable at retaining its value

- More effective as a medium of exchange

- A better measure of value in the commodities and services we regularly purchase

Over the years, we have seen a variety of proposals for complementary currencies. In fact, some are already in use today. But they suffer under the unfair advantage of our officially-sanctioned, cartel currency, the Federal Reserve dollar.

Gold clauses and similar mechanisms may still be legal. But even our existing laws still declare the Federal Reserve dollar to be the only official tender that can be used to satisfy any debt, whether public or private. If you lack the foresight to include an alternate form of payment in every contract you make, you could still get stuck with payment in a devaluated currency.

If consumers don’t like that, and they begin to move to a more reliable form of payment, the government believes it has the power to make that better kind of money effectively illegal.

In order to encourage complementary currencies which are not dependent upon the dollar to derive their value, we really should repeal even our existing legal tender laws. More importantly, we need to assure consumers there will be no return to the oppressive monetary policies instituted in 1933.

We must not be afraid to allow producers and consumers to select the kind of money they prefer to use. And we should be able to trust our government to do its job of enforcing our privately executed contracts, regardless of how we choose to make payment.

We should not be forced by law to use Federal Reserve dollars when we really could have more choices. This notion of a government-sponsored monopoly for the creation and management of money may have seemed a little easier to justify 100 years ago. But not today.

New technology allowed us to tear down the regulatory barriers to entry, helping small business compete in the telecommunications industry. We now have the technology to effectively support multiple, privately issued and managed currencies.

To a minor degree, this is already done today. You might still carry around a little paper money in your wallet. But if you are like most people, most of your purchases are now done using a credit card or some other electronic payment system.

A credit card is not legal tender so anyone can refuse to accept it. Nearly all businesses are now equipped to process any major credit card. In some places, a card may even be preferred over cash.

The additional overhead cost is often compensated by an increase in convenience and reliability. Credit cards are good for business so businesses generally accept them.

In the same way, a new complementary currency that is convenient and dependable could also come to be accepted anywhere you might need it. And even if it is not widely accepted, techonology has now advanced enough to make it possible anyway.

For example, a merchant might not even have to know, or care what kind of money you use. You might buy using the money you choose and he could sell using the money he chooses. Then, the banks you each use could work out the details much as they do now when you make a purchase in a foreign country.

The short term debt your credit card company allows you to accrue each month is money, just as the debt you create when you borrow to buy a home. It is credit money, created out of debt and backed by you. It is money in much the same sense as Federal Reserve money. It is just a complementary, or additional form of money you can choose to use if you want to.

Credit cards do offer some small degree of choice. But they do not really offer the kind of diversity and competition we would get from a truly independent complementary currency. Their primary limitation is, they are still linked to the Federal Reserve.

Credit card transactions are typically denominated in dollars so the money they create is subject to most of the same inherent problems such as reliability, interest, inflation and so forth. So while short term credit is good for buying this month’s necessities, it is not the kind of money you would want to use to store value for a future retirement.

In recent years, we have seen the emergence of a new form of money called “crypto currencies.” Perhaps the best known example of these is “Bitcoin.”

Bitcoin was designed to be similar to gold in certain ways. There is only a limited amount of it that can ever be discovered, and it is intended to be difficult to come by.

This means, as long as people are interested in owning Bitcoins, they will tend to go up in value because they will become harder and harder to get. Individual Bitcoins can also be divided up into very tiny parts. This is much more flexible than a dollar, for example, which can be effectively divided only into 1/100th parts, or cents. The theory is, as each coin continues to appreciate in effective value, people can just use smaller and smaller bits of it for each transaction.

Unfortunately Bitcoin still suffers from its own set of problems–some even worse than our existing Federal Reserve dollars. In a way, we can consider it to be a fiat currency too, at least in the respect that it is not backed by any useful or inherently valuable commodity.

A Bitcoin is only valuable if someone else wants to buy it. Otherwise, it is just a number in a computer somewhere. You can’t eat it and you can’t use it as a material to make anything. It is only useful as long as someone will accept it as exchange in a transaction.

As a result, the value of a Bitcoin is likely to change substantially over time as people’s perceptions of it change. In other words, its value is highly speculative and very volatile. We can expect the price of Bitcoins to fluctuate in large swings, both up and down.

The inherent structure of the Federal Reserve dollar means it is sure to gradually lose its value over time. In contrast, Bitcoin is designed to increase in value over time–at least as long as people continue to believe it is desirable. In other words, fractional reserve money is inherently inflationary and Bitcoin is inherently deflationary.

Because a Bitcoin’s value is solely built on speculation, that value is bound to be quite volatile. This means the people who mine, or buy it early, will benefit from its appreciation. But these gains will come at the expense of others who buy in later on.

Bitcoin has been quite successful in spite of these problems. And it has made a number of early adopters very wealthy. But at some point, people may begin to perceive it as an “insiders’ game” or even a Ponzi scheme. If so, it could well begin to lose value as fewer people choose to use it.

One of the outgrowths of Bitcoin has been the evolution of a variety of other competing crypto currencies. As people have discovered the strengths and weaknesses of Bitcoin, some have attempted to make their own similar currencies.

This makes a lot of sense when you understand how the system works. Just be the first one to mine a large chunk of the available coin supply. Then convince other people to join in and you could quickly become very wealthy.

As of this writing, there are hundreds of crypto currencies competing with Bitcoin. Two more prominent examples are Litecoin and Ethereum. But they share one thing in common: they are, for the most part, completely unbacked currencies. They have no inherent value other than the demand people create for them due to their own perceptions. If those perceptions change to disfavor, the value of a crypto-coin can easily fall–possibly even to zero.

Perhaps one of the greatest benefits to come from Bitcoin and its derivatives is their demonstration that competing currencies really can be conceived, implemented and used. And they don’t have to be indexed in, or linked to the value of dollars. We don’t have to be stuck using only Federal Reserve notes and credit cards. We should be able to conceive entirely new systems, but hopefully backed in better and more reliable ways.

Bitcoin has shown us that a world is possible where multiple currencies exist in a single economy. Maybe we are ready for a new kind of money that will:

- Have the convenience of our current electronic checkbook money

- Enjoy the freedom and flexibility of Bitcoin

- Hold a constant and stable value–even over much longer periods of time

In addition to crypto currencies, there are a number of other initiatives under way, in various stages of conception or practice. Each contains its own unique contribution to enhance our available choices for what kind of money we will use.

Some examples of this:

Next, we will discuss the GotChoices strategy for new money.